It’s natural then for one to ask: How much is my data worth?

Unfortunately, there isn’t an accepted financial model to answer this question, but there are familiar and less formal approaches, both financial and non-financial, for valuing data assets. By examining them, businesses can become more deliberate and purposeful in how best to use their data.

Be exclusive, granular

A basic approach to understanding the relative value of data is to think about it in terms of exclusivity and specificity.

he more exclusive it is, the more valuable. Insights mined from private data collected from your customers is certain to be more valuable than the data from public sources.

Likewise, granular data is more valuable than less specific data because it allows for more options in slicing and dicing information and combining it with other data sets. The addition of more specific personal information (e.g., income, family size, affinities) to a customer profile warrants fresh prospects for analytical exploration.

Augment your data

One way to make your data more exclusive and granular is to augment it with related data from third party providers. You can look at these third-party data providers in two ways. One is to augment your data with theirs to improve the quality and quantity of your data assets.

Alternatively, you can sell your data to them and generate an immediate revenue stream. For a deeper read on this topic, explore this article on how to monetize data with alternative data providers.

Value your data

One way to estimate value is to use traditional methods for valuing intangible assets, such as intellectual capital and brand equity.

Traditional methods of valuing intangible assets include:

- Cost-based (cost to create the asset)

- Market-based (price of comparable goods)

- Income-based (value assigned by projected cash flows from the asset) accounting methods.

The characteristics of data make these methods complicated to execute. However, determining consistency of the features that make data valuable offers a structure for measuring that value.

Understanding why the different characteristics of data make it so difficult to quantify in absolute terms actually helps in understanding its intrinsic value.

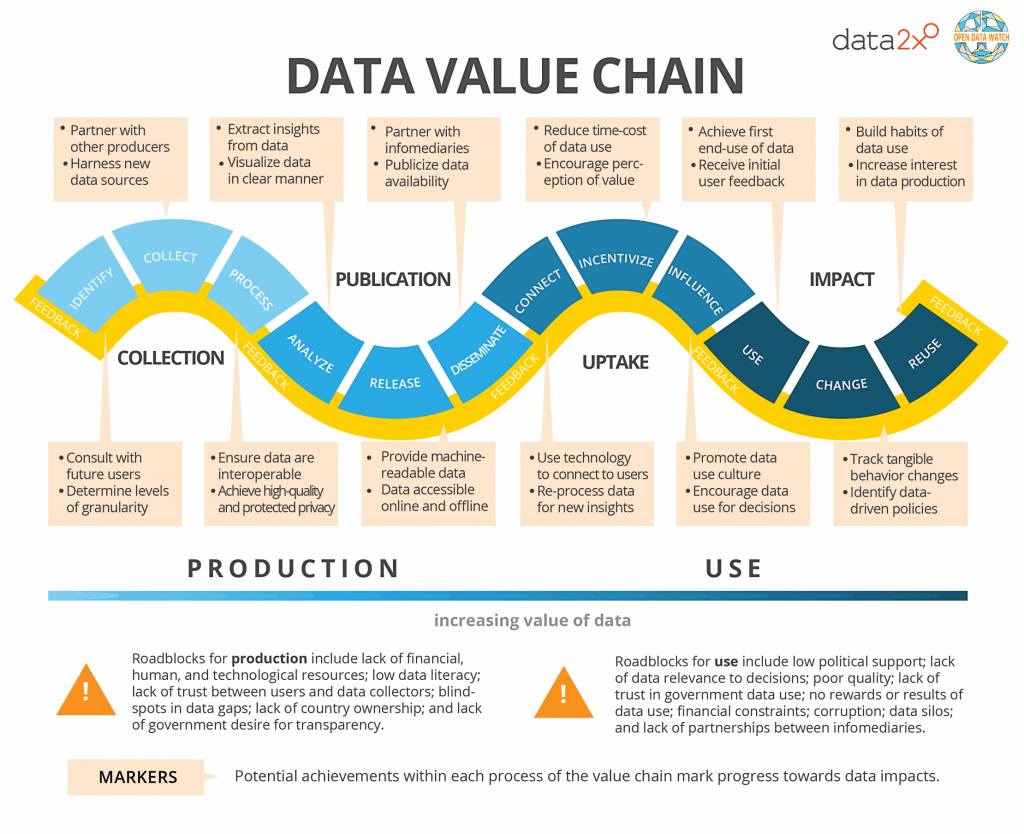

An analysis of a data valuation chain by Open Data Watch illustrates this:

Source: Open Data Watch

As data passes through stages of transformation from raw data to analysis, insight, action and value, its worth increases. The valuation chain must be completed to realize value, but there are other potential outcomes, both good and bad.

For example, multiple value chains can originate from the same raw data when the same aggregated GPS data is used by both a retailer to choose a new store location and a city government for better road planning.

In other cases, the valuation chain can be completed only to result in no value. Overall, the value chain method is beneficial in considering data’s specific uses, increases or decreases in value and other factors in buying and selling data.

Why learn the value of your company data?

Organizations should first identify the objective for valuing information assets. Is the purpose to improve your information management discipline, or to leverage the information’s economic benefits?

Gartner offers a more robust model in its approach, encouraging you to apply the same rigors to valuing your information assets as you do to other critical enterprise assets. The Gartner Information Valuation Method prescribes a set of six measures for valuing information, including intrinsic value, based on the quality of information assets, and economic value, measuring the contribution to an organization’s bottom line. It’s easy to imagine an organization employing multiple measures, depending on the type of data being valued.

Quantifying the value of data can be complicated, but it’s important.

It’s unlikely that data will appear as an asset on a balance sheet anytime soon, but that doesn’t mean it doesn’t have value. Businesses must be deliberate and purposeful in how they consider its value and adopt appropriate measures for doing so. Data is a strategic asset and is growing in importance.

As the old adage goes, “You can’t manage what you don’t measure.” Organizations need to start inventorying and measuring their information assets.